⚠️ Help us fight fraud – Learn more

It’s a wrap

with the Yuh payment app

Time to control your finances with the best payment app. Unleash your inner money manager and call the shots with your cash.

Hassle-free online payment

Free Yuh Pocket insurance for your purchases

You know what? It’s OK if your phone, keys or wallet break or disappear. Yuh Pocket, automatically insures purchases made with your Yuh card free of charge.

Learn more

Fee-free Yuh card

Our free Yuh Mastercard is a hottie with skills: it costs you 0.- and you can shop with complete clarity over what you pay.

Free

It costs 0 CHF!

No hidden fees

We keep all fees transparent

Your wallet in your phone and your watch

Convenience has a name. We call it Apple Pay, Google Pay, Samsung Pay and Swatch Pay. For fast, private and secure payments straight from your smartphone or your watch.

Multi-currency payment account: 1 IBAN, 13 currencies

Your multi-currency account has 13 pre-installed currencies under one single Swiss IBAN.

The Yuh virtual card

is here

The virtual card, a fee-FREE spirit

Our virtual card is a weightless wonder that’s available as soon as you open your account. Activate it directly in your app. Just like its physical counterpart, it’s free.

Life in plastic?

Not fantastic!

100% digital, 0 plastic

3-D Secure

Transactions in real-time

Security first

Your assets are protected

A payment app without hidden fees

Nor in the depths of the fine print. We are fully transparent about fees and avoid them whenever possible.

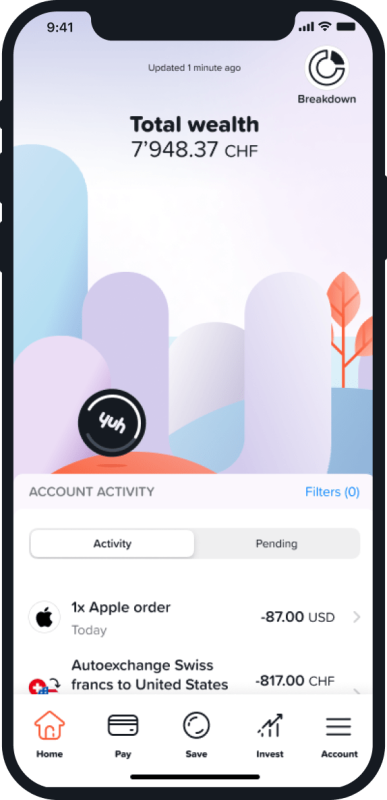

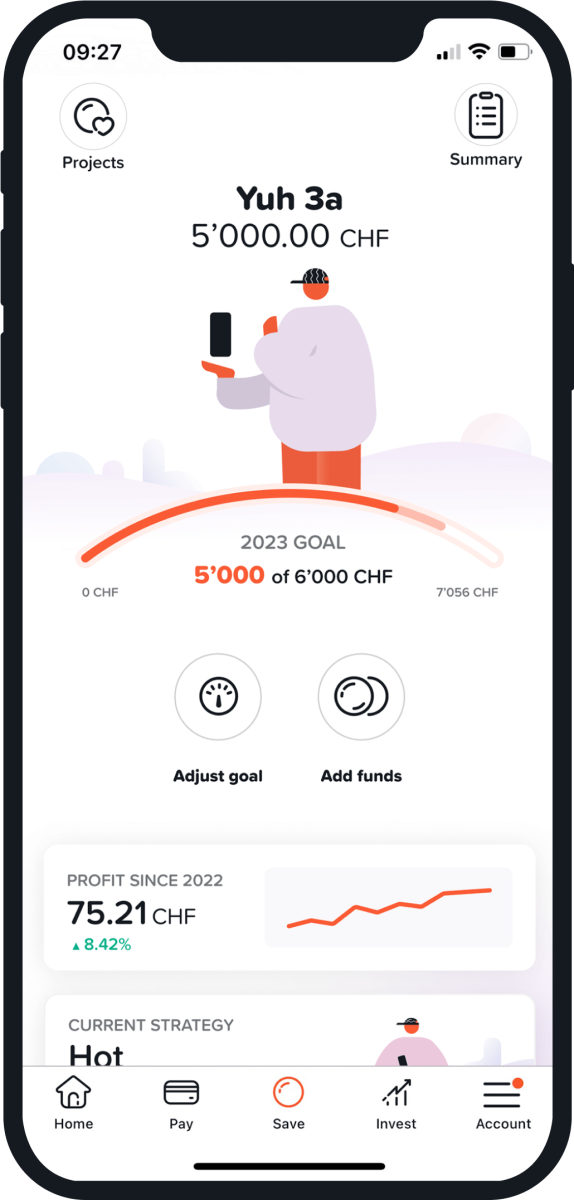

Such a pretty and easy app

Peekaboo! Take a look at the Yuh app. You’ll be surprised by all the money matters it can handle.

Open your Yuh account

Got your smartphone, valid ID and a utility bill at hand? WiFi’s working? Then you’re ready to go!

Get the app

Create your account

Top up your balance

Get the app

Get the app

Create your account

Create your account

Top up your balance

Top up your balance

Still raising an eyebrow in doubt? Ask us about anything that’s keeping you from sleeping at night!

Virtual card:

Follow these steps to activate your beautiful candy-coloured virtual card:

- Open your app

- Go to Pay>Card (top right of your screen) and swipe to the virtual card

- Select Activate now and follow the steps in your app

Voila! Your card is now ready to roll online.

Want to use it in physical stores, too? Follow a few more steps in order to make that happen:

- Download or open one of your payment apps on your phone (Apple Pay, Google Pay, Samsung Pay)

- Open the Yuh app

- Go to Pay>Card (top right of your screen) and tap on Add to Apple/Google/Samsung Wallet or Pay

Aaaand there we go: Your card is now ready to use anywhere.

Physical card:

What’s that? You want a plastic card too? Like in the good old times? No problem, Yuh got it! Just follow a few easy steps:

- Open your app

- Go to Pay>Card (top right of your screen) and select your physical card

- Select Activate now and it will be delivered to your doorstep in a few days

When you have that black gem in your hand, head right over to your Yuh app, tap once again on Pay>Card, select the physical card and we’ll tell you what to do.

Keep your card close to you as you’ll need to enter the last four digits of your card number and the expiry date. Insert your Yuh Key to validate the card and you are ready to use it straight away.

Wait, not straight away: Before making its maiden voyage to various POS terminals, you need to activate it by withdrawing cash or checking your balance at an ATM.

Happy shopping!

You already know that we keep our standards high and our fees low. The currency exchange fee is 0.95% for all the currencies available in the app. For currencies not included, the currency exchange fee is also 0.95% when using the debit card abroad. Fees are already included in the exchange rate displayed in your Yuh app.

Whether you are renting a bungalow on the beach or reimbursing a friend abroad, nothing could be easier! With Yuh, you can transfer money in 13 currencies [CHF – USD – EUR – GBP – JPY – AUD – CAD – SEK – HKD – NOK – DKK – AED – SGD] to SEPA* and IBAN countries. All you have to do is enter the bank details of the recipient (BIC and IBAN) and choose the currency. It is as simple as that! Not only that—transfers in euros are free.

*What are the SEPA countries? The Single Euro Payments Area is a pan-European community which aims to make payments in the euro zone as easy and safe as national payments. Here is a list of SEPA countries: Andorra, Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, the Netherlands, Norway, Poland, Portugal, Romania, San Marino, Slovakia, Slovenia, Spain, Sweden, Switzerland, the United Kingdom and Vatican City.

Yuh payment cards support 3-D Secure, the internationally-recognised security standard for online payments by card.

Many online stores offer 3-D Secure, and you will be invited to register your card for this functionality upon your first online payment that requires 3-D Secure.

Once you have registered, you will then receive a code via SMS on your mobile phone to authenticate each online payment supporting 3-D Secure.

Wow, we said “3-D Secure” a lot there, didn’t we? 3-D Secure.

First, the short answer: Transaction fees are charged for each transaction you make, whereas exchange fees are charged each time you convert one currency to another. If this makes you gasp in horror, take a breath and read on – there’s good news at the end.

Transaction fees are a charge which banks apply each time they process a transaction. Chargeable either as a percentage of the transaction cost or as a fixed amount, these costs often sneak under your radar without you even realising!

Similarly, exchange fees are a percentage charged by banks when you need to convert one currency into another, such as when you’re abroad or shopping online from outside your home country.

With Yuh, you don’t pay any transaction fees on 13 currencies pre-installed in your account, and our currency exchange rate is only 0.95% … so you can relax and fully concentrate on making the most of your time abroad. See, we told you there was good news.

Due to compliance reasons, the Yuh Mastercard can no longer be used with cryptocurrency providers. Thank you for your understanding.

YuhLearn: Get the skills to pay the bills

If you like our payment features, you’ll like these too: